Wolfsdorf Immigration Law Group

Here’s why:

1. About 11,000 new I-526 petitions were filed in fiscal year 2014 representing over $5.5 billion in new investment, an increase of 72% over the previous year. Since the program involves at least a 5-7 year deal flow, $20-$25 billion in new investment is at stake.

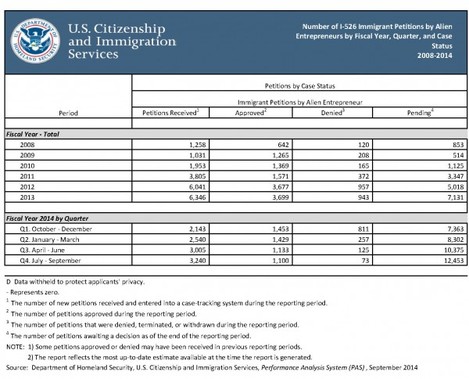

2. U.S. Immigration approved 5,115 EB-5 petitions in the year ending September 30, 2014. For the second half of the year, only 198 were denied, reflecting an approval rate of over 91%. Final stage I-829 applications had an even higher approval rate of almost 95%. These appear to be the highest approval rates on record. Adjudications also sped up as over 1,000 matters were processed in November 2014. See chart below.

4. A Chinese EB-5 quota, or waiting line, often called “retrogression,” is a certainty and the China EB-5 cut-off date will start in May or June 2015. The waiting line for a final interview will be about 2 years. Therefore cases filed before about May 2013 will be eligible for final interviews in May or June 2015. The March 2015 Visa Bulletin, which is published mid-February 2015 will most likely have critical information regarding the date of the establishment of the China cut-off date.

5. During the months from May 2015 to September 2015 this waiting line will increase from about 2 years to as long as 3 years. While there has been talk about counting only petitions or families, instead of individuals, a more likely possibility is the Obama Administration will allow investors to be admitted to the U.S. before their priority dates become current. Also, principal Chinese investors who are in valid status in the U.S. may be allowed to file an application to adjust status, even though there numbers are not current. Those who file for adjustment of status will be issued work and travel permits while waiting for their green cards.

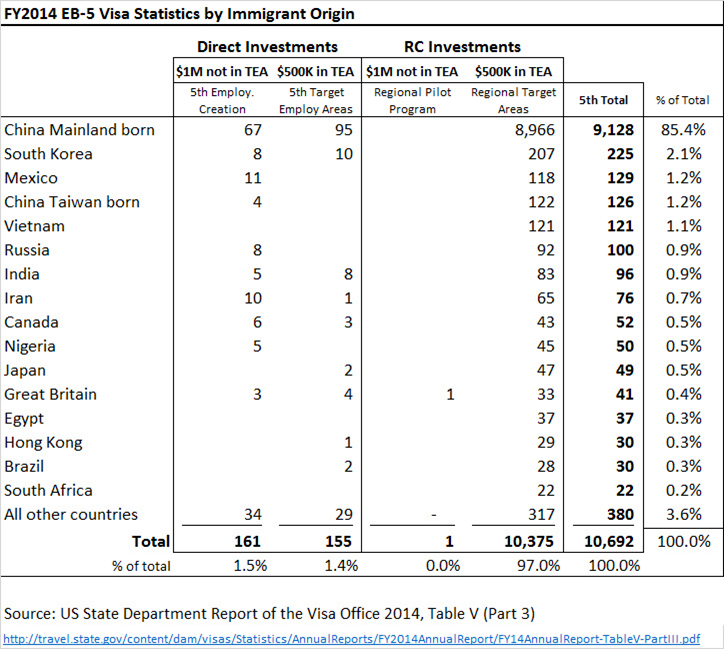

6. 97% of investors have selected regional centers. Only 316 investors filed direct or stand-alone EB-5 petitions in fiscal year 2014. This is less than 3% of the total. The Regional Center Program is therefore a huge success.

7. If you have a derivative child who will age out because the I-526 petition was filed too close to the Child’s 21st birthday, consider requesting an expedite based on current USCIS guidelines.

8. If you haven’t yet filed your EB-5 application, and there is a derivative child over 18, consider filing with the child as the principal applicant.

9. If your petition has been approved and there is a child beneficiary still under 21 years old, based on the Child Status Protection Act definition, be sure to take steps to “lock-in” the child’s age by filing forms DS 260, and paying the State Department fee bill, or by filing an adjustment of status application, if possible.

10. For those thinking about applying for an EB-5 investor visa, the time to file is now. The Regional Center program needs to be extended by Congress as it expires in September 2015. While Congress has extended it many times, this extension may come with conditions. For example, the amount of $500,000 was set almost 25 years ago in 1990. That amount presently has the purchasing power of only $275,235, when adjusted based on the Consumer Price Index. Will Congress increase the amount, my guess is they will.

CONCLUSION

With at least $20 billion at stake, and thousands of jobs being created every year, the EB-5 program will continue to thrive. It is probably the only jobs program that doesn’t cost the government a single dollar. Therefore, as new wealth creation continues to provide mobility for high-net worth investors, the EB-5 program will increase in popularity.

For those thinking about applying, the time to file is now. Expect to see a substantial increase in the minimum investment amount, and if you are Chinese born, expect a 2-3 year waiting line. Eligibility is established by filing so do your due diligence as to the project and be decisive. The EB-5 program, like the goat, is resilient and resourceful.

Wolfsdorf Rosenthal LLP holds regular free immigration webinars on a broad range of topics. The January 20, 2015 webinar will be held with Henley & Partners and will focus on Global Investor Citizenship and Residence Programs, including the U.S. EB-5 Program. Register HERE.

RSS Feed

RSS Feed